-

What are Opportunity Zones?

An Opportunity Zone is a low-income census tract with an individual poverty rate of at least 20 percent and median family income no greater than 80 percent of the area median.

Census tracts are statistical subdivisions of a county established by the U.S. Census Bureau. Each tract averages between 1,200 and 8,000 in population and the nominated tracts vary in size from 199 acres to 235,352 acres.

Opportunity Zones are probably best understood not as a new grant program but as a new investment tool that creates tax preferences, which then drives individual and market behavior.

With minor exceptions, the federal statute is not prescriptive in terms of the types of qualified investments, which can range from affordable housing to clean energy to infrastructure to small business to workforce. This provides flexibility to craft local and state strategies that will focus these investments to ensure they deliver living wage jobs, increase affordable housing, prevent unwanted gentrification and build resilient communities. -

What is the benefit of an Opportunity Zone?

An Opportunity Zone can receive funds from Opportunity Funds. The program provides a federal tax incentive for investors to use their unrealized capital gains into Opportunity Funds dedicated for investing in the designated Opportunity Zones.

The fund model enables a broad array of investors to pool their resources in Opportunity Zones, increasing the scale of investments going to underserved areas.

-

How many Opportunity Zones have been selected?

Each state may nominate a minimum of 25 total eligible census tracts but no more than 25 percent of the total number of eligible census tracts within the state. In California, there are 3516 income census tracks in California. 879 were approved in the state of California.

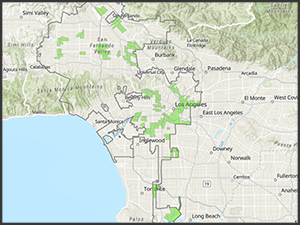

In the City of Los Angeles, there are 193 Opportunity Zones. Review the LA City Planning Department's Opportunity Zones Map for eligible tracts within the City boundaries.

-

How do I find more information on Opportunity funds?

The US Treasury and the IRS have issued an initial set of proposed regulations and guidelines on how the Qualified Opportunity Zone tax benefits under IRC 1400Z-2 (including the certification of Qualified Opportunity Funds and eligible investments in Qualified Opportunity Zones) will be administered. The IRS has also posted a more comprehensive list of Frequently Asked Questions about Opportunity Zones on their Tax Reform pages.

Questions and comments may be submitted on the proposed regulations electronically via the Federal Rulemaking Portal at Regulations.gov. The Tax Reform section on the IRS website will post additional Opportunity Zone information as it becomes available. For any other Federal questions, please contact the IRS through their semi-automated system at 800-829-1040.

California specific information on Opportunity Zones can be found through the California Opportunity Zone Portal.

-

Who do I contact for local information?

For more information, please contact:

Fred Jackson

EWDD Assistant General Manager, Economic Development

This email address is being protected from spambots. You need JavaScript enabled to view it.

-

Other Opportunity Zone Related Resources

California Opportunity Zone Portal

Opportunity Zones Resources - Community Development Financial Institutions (CDFI) website

Opportunity Zones in California - California Department of Finance website

LOS ANGELES ECONOMIC INCENTIVE AREAS MAP

map provided by the City of Los Angeles Department of City Planning